Managing W-9 Compliance for Participants

SaaSquatch can help you track which of your participants have provided you a valid W-9 Tax form.

The United States requires a W-9 Tax form when a company gives over $599.99 USD of rewards to an individual in a calendar year.

Learn more about SaaSquatch's W-9 Compliance Functionality here: W-9 Compliance

To activate W-9 compliance functionality for your program contact your Launch Manager or Solutions Architect.

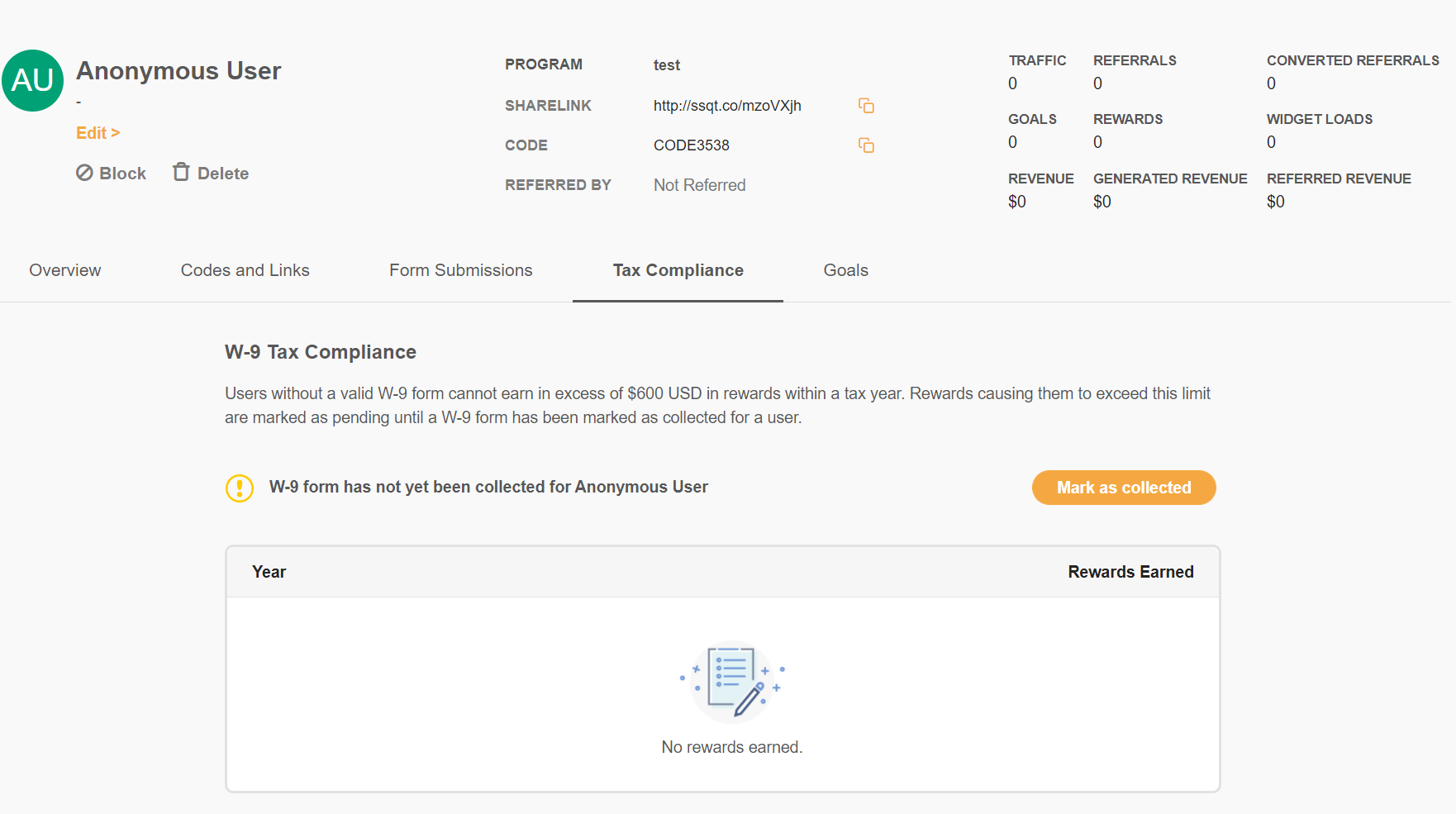

🔗 Marking a Participant’s W-9 Form as Collected

- Head to your SaaSquatch account.

- In the upper right corner of your SaaSquatch account select either your Live or Test tenant.

- Click "Participants" in the upper header of your SaaSquatch account.

- Find the specific participant you would like to mark W-9 Collected for. Click their name.

- Click the "Tax Compliance" tab under their Referred by code information.

- Click "Mark as collected" and confirm they have provided you a valid W-9 Form.

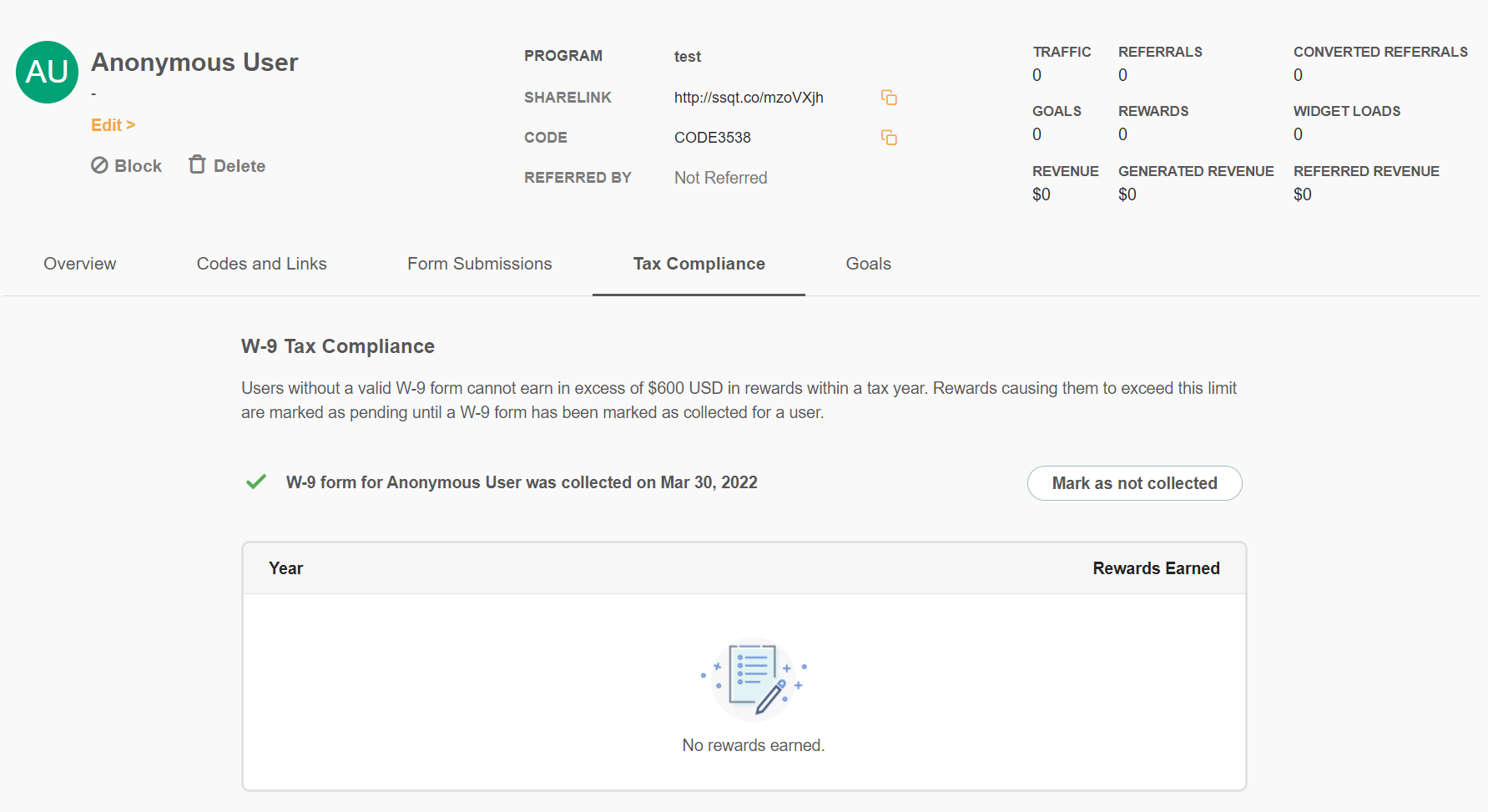

- The Participant is now marked as having a valid W-9 Form. They can earn over $599.99 USD in rewards each year.

Any historical rewards pending due to W-9 not being collected will become available. There will no longer be a $599.99 USD reward limit for current and future tax years.

🔗 Marking a Participant’s W-9 Form as Not Collected

You can change the collection status of a participant's W-9 Form.

- Head to your SaaSquatch account.

- In the upper right corner of your SaaSquatch account select either your Live or Test tenant.

- Click "Participants" in the upper header of your SaaSquatch account.

- Find the specific participant you would like to mark W-9 Collected for. Click their name.

- Click the "Tax Compliance" tab under their Referred by code information.

- Click "Mark as not collected"

- The partipant is no longer considered to have a valid W-9 Tax form.

Changing a participant's W-9 status from "Collected" to "Not Collected" will not retroactively move participant's earned rewards to Pending (Regardless of if they are over $599.99USD/per calendar year). Future rewards will be follow W-9 compliance.

🔗 Check Participant's W-9 Form Status

You can check a partipant's W-9 form collection status and see the amount of rewards earned in a calendar year.

- Head to your SaaSquatch account.

- In the upper right corner of your SaaSquatch account select either your Live or Test tenant.

- Click "Participants" in the upper header of your SaaSquatch account.

- Find the specific participant you would like to mark W-9 Collected for. Click their name.

- Click the "Tax Compliance" tab under their Reffered by code information.

- Here you can view their W-9 Form collection status and a breakdown of Rewards earned per calendar year.

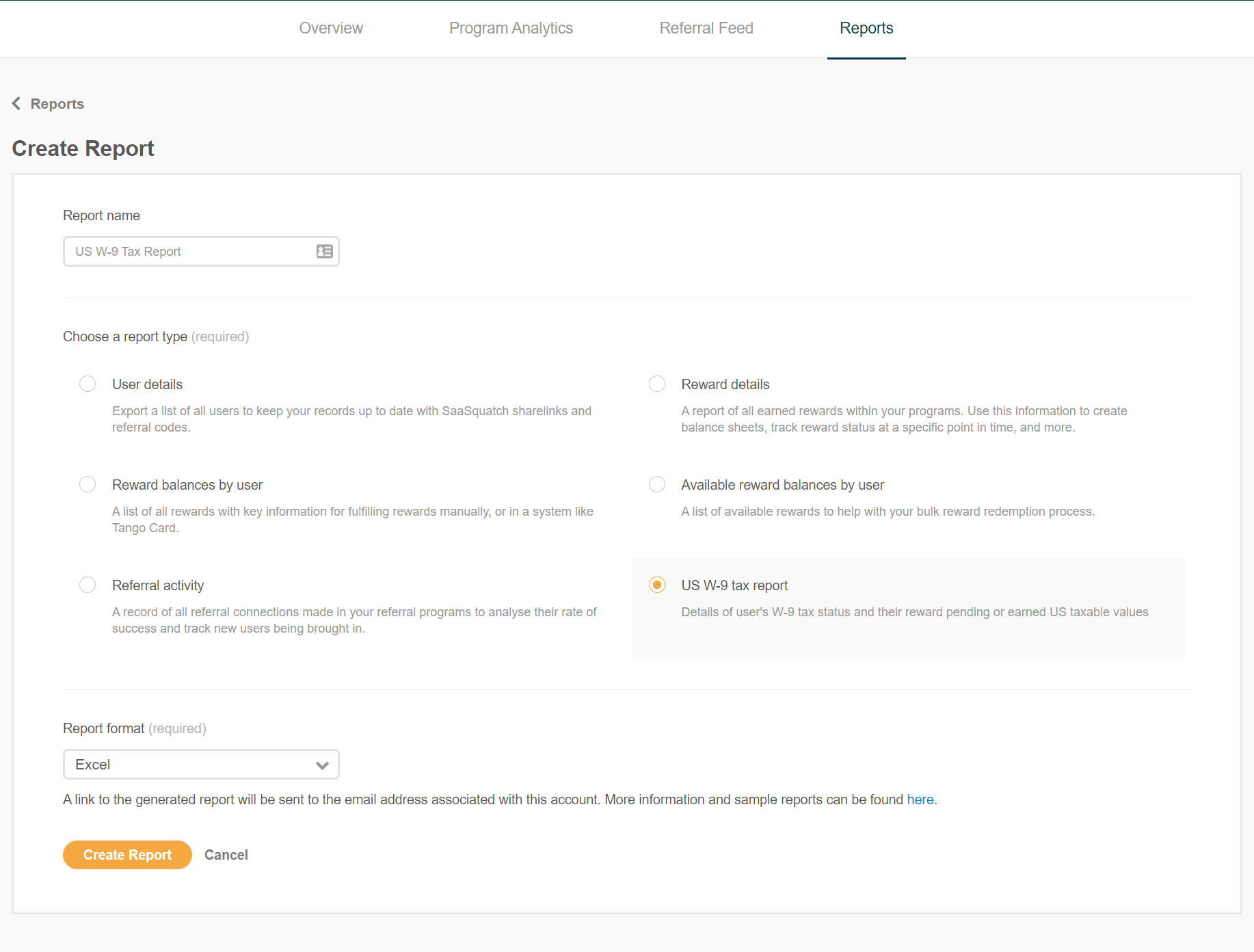

🔗 Exporting the US W-9 tax status of all users

SaaSquatch provides a US W-9 Tax Report, which provides information on all users and makes it possible to identify:

- Which users have not yet submitted a W-9 form

- Users who have hit their tax year limit, and have pending rewards

- The total amount of taxable rewards received in previous years

To access the report:

- Head to your SaaSquatch account.

- In the upper right corner of your SaaSquatch account select either your Live or Test tenant.

- Click "Analytics", then "Reports".

- Click "Create Report".

- Select the "US W-9 tax report"

- Choose the output format - both Excel and CSV are supported

- Click "Create Report"

The resulting report will contain the following columns:

| CSV | Excel | Description |

|---|---|---|

| userId | User ID | The user's ID. |

| accountId | Account ID | The user's account ID. |

| The user's email address. | ||

| firstName | First Name | The user's first name. |

| lastName | Last Name | The user's lastName. |

| dateUsTaxFormSubmitted | Date US Tax Form Submitted - YYYY-MM-DD | The date that the user submitted their W-9 form. This will be blank if they have not yet submitted a W-9 form. |

| year | Year | The tax year that this row pertains to, or the value "PENDING" if this row indicates a user's pending reward value and count. |

| value | US Taxable Value in Cents | The total US taxable value of rewards earned in cents. |

| valueInDollars | US Taxable Value in Dollars | The total US taxable value of rewards earned in dollars. |

| count | Reward Count | The number of rewards that contribute to this row's US Taxable Value |